The Federal Open Market Committee, part of the US Federal Reserve, holds eight regularly scheduled meetings each year. Minutes of these meeting are released three weeks after policy decisions. However, a press release statement is published earlier.

Since March 2023, every Federal Reserve press release has begun its second paragraph with the following wording:

The U.S banking system is sound and resilient.

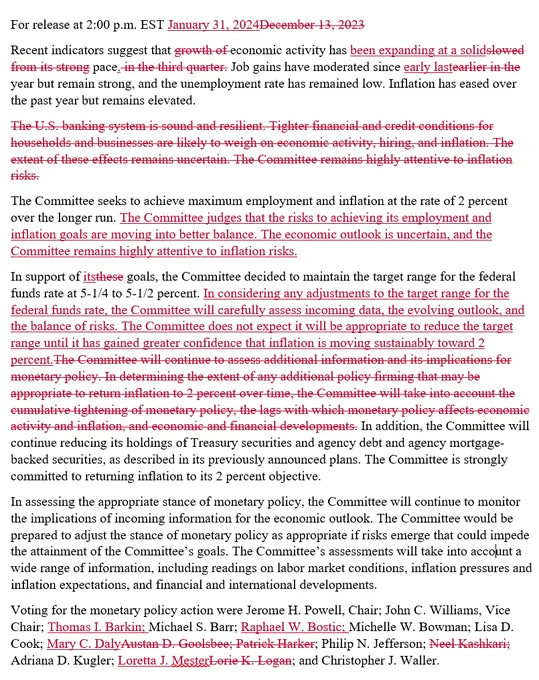

However, the recently published January 2024 release has some interesting changes.

The second paragraph beginning with “the U.S. banking system is sound an resilient” has purposefully been removed.

Should we be worried!?

Does this mean the U.S. banking system is no longer sound and resilient? That’s a rhetorical question, we all know the answer to that.

"Sound and resilient" is the banking equivalent to "Safe and effective"....

My husband has a higher "economics IQ" than most (certainly, it's higher than mine!). He's been watching the interest rates propaganda for the last few years, and he's notice a pattern of late:

They make out like the lowering of interest rates is "right around the corner." Next quarter, next season, next year. But as they approach that magical time, "inflation" ticks up, and, you know, to be responsible, they have to keep interest rates up.

In the meantime, a whole whack of new debt-slaves have been created from amongst the hopefuls who believed them when they said interest rates would come down.