Of Theory and Practice - In Search of Explanations

A follow up to The Everything Bubble, The End Of Growth & Managing Expectations

A few weeks ago I wrote an article called - The Everything Bubble, The End Of Growth & Managing Expectations. It was an attempt to summarise the work of Dr. Tim Morgan, former Head of Research at Tullett Prebon, a world-leading intermediary in the wholesale financial and energy markets.

I am grateful to Tim for reading the article and for referencing it in his own latest article which follows below.

Of theory and practice - In Search of Explanations by Dr. Tim Morgan

Even with the best intent, it can be hard for anyone to pause and take an objective look at his own work. For this reason, I’m very grateful to blogger The Naked Emperor (NE) for an article, entitled The Everything Bubble, The End Of Growth & Managing Expectations – A theory to explain everything, which sets out an admirably concise, balanced, accurate and readable summary of my economic thesis.

The bottom line of this thesis is that growth in the material economy of products and services has drawn to a close, and involuntary economic de-growth has begun. The financial system, entirely predicated on the contrary assumption of growth in perpetuity, has become disconnected from economic reality.

I don’t contend that the reversal of prior economic expansion has been any kind of sudden event – on the contrary, we’re witnessing the culmination of a decades-long process in which the economy has moved from deceleration, via stagnation, into contraction. If we haven’t seen this coming, it’s largely because we have had no wish to do so.

If I read the article correctly – and NE is welcome to put me right if I don’t – the inference is that the authorities’ own assessment of the situation runs along similar lines, and that this kind of analysis “convinces politicians to pursue policies which don’t seem to be in the public’s interest”.

This, NE says, could explain why we see “governments pushing for ever greater control”, which they will need “to control citizens as their prosperity declines”. NE cites my recent identification of an emerging “modified consensus” as evidence that “they are managing expectations downwards”. Pandemic lockdowns, “a self-destructive Net Zero agenda” and soaring immigration are placed in this same sequence of interpretation and response.

I can’t know if the authorities do see things in this way. What I can say, though, is that there’s no reason why they couldn’t have reached the same conclusions and, if they have, then many of the actions cited by NE would fit into a logical pattern.

What’s should we expect?

NE traces my writings as far back as ‘Perfect storm – energy, finance and the end of growth’, published in 2013, when I was Head of Research at Tullett Prebon, a leading intermediary in international financial and energy markets. NE summarises my conclusions as “a financial shock that will dwarf 2008”, “government breaking down in the face of failing prosperity”, and “the acceleration of economic deterioration”.

As things stand, a financial shock of unprecedented severity has become inescapable, because the financial system, understood as a vast interconnected mass of forward promises, now incorporates commitments far in excess of anything that the economy itself will be able to honour. High inflation would be one way of destroying excess forward commitments, but this could only work to defuse existing financial obligations if we didn’t simultaneously carry on creating new ones.

Part of the problem is that the authorities have only limited oversight over what’s happening to the creation of financial liabilities. They can’t control the supply of “shadow credit”, for which we don’t even have complete data. Some forms of non-bank credit, being already costly, have limited sensitivity to rate rises. ‘Buy now, pay later’, the label attached to some types of consumer credit, could be used as a description for what has happened to the financial system as a whole.

We might describe this as the provision, to households, of debt that they can’t repay to buy things that they don’t need.

Economic deterioration has long been under way in the West, and most EM (emerging market) economies, too, have now reached the point at which prior growth in material prosperity goes into reverse. The emergence of a “modified consensus” suggests to me that we’re nearing a point at which prior assurances of infinite economic expansion lose their credibility.

Whether government breaks down will depend very largely upon the ability of leaders to grasp what’s happening, and commit to tackling it in a way consistent with the best interests of the general public. To be sure, there’s scant evidence of any such commitment at present, but political trends do tend to be shaped by economic developments. It’s not impossible that major financial and economic crises will bring to the fore a new cadre of leaders who are more aware of economic reality, and more committed to the public good.

The incumbent strategy – if indeed there is one, beyond ‘buying time and hoping that something will turn up’ – seems to be to promise that current hardships, though they may prove protracted (the “modified consensus”), will be followed by a golden age of prosperity and environmental stability (“sustainable growth”), delivered by the march of technology and an abundance of low-cost energy sourced from renewables.

As I see it, this vision is extremely implausible, and so, therefore, is the maintenance and increase of the wealth and power of incumbent elites. The Naked Emperor may well be right about fear of the consequences of economic contraction being the motivation behind “governments pushing for ever greater control”.

The thesis

The central idea of my interpretation is the need to recognise the concept of two economies. These are the ‘real economy’ of material products and services, and the parallel ‘financial economy’ of money and credit. Making this distinction enables us to examine, as separate entities, the nature of each economy, and make comparisons between the two.

The ‘real’ or physical economy is an energy system, reflecting the obvious fact that nothing that has any economic utility at all can be made available without the use of energy. It’s equally obvious that money has no intrinsic worth – it would be of no use to us if we were stranded on a desert island – but commands value solely in terms of the things for which we can exchange it.

In other words, money functions only as a ‘claim’ on material products and services.

Accordingly, the ‘financial’ economy is a ‘claims proxy’ of the real economy.

Time to move on

The ‘two economies’ concept provides us with two interpretative opportunities. The first is that we can reject – or rather, we can move on from – an orthodoxy which states that the economy can be explained in terms of money alone. If we were to accept that money is the only driver of the economy, then the fact that money is a human artefact entirely under our control could easily lead us to conclude, quite mistakenly, that there need never be any limit to the scope for economic expansion.

By dismissing the constraints of the material in this way, conventional economics makes the illogical promise of ‘infinite growth on a finite planet’. It implies – dangerously, in my view – that we can use money to work around all physical limitations. If this were true, we could resolve our climatic and ecological problems by sending a cheque to the environment. The banking system could lend resources (including low-cost energy) into existence, and central banks could conjure them ex nihilo out of the ether.

In short, this is a tarradiddle, and has long been challenged by rational thinkers. The authors of the remarkably prescient The Limits to Growth (LtG) emphasised the primacy of the material back in 1972. In the following year, Kenneth Boulding, co-founder of general systems theory, said that “[a]nyone who believes exponential growth can go on forever in a finite world is either a madman or an economist”.

Reasoned analysis, then, has been knocking on the door for at least half a century.

Re-interpreting economics makes far more sense than trying to co-exist with the consequences of nonsense. There are plenty of reasons to think that we may now have the chance to move on with our economic thinking. This opportunity exists because material problems are forcing themselves upon our attention.

Environmental hazards, for example, which are amongst today’s most important issues, are emphatically material, and cannot be resolved financially.

Just as importantly, there is increasing evidence that prior growth in the physical economy of products and services has been faltering towards reversal. We’re seeing this at first-hand in widening hardship. Efforts to restore “growth” with credit and monetary gimmickry have been tried ever since the 1990s, and have failed spectacularly.

In short, the large and complex modern economy has been a product, not of money, but of energy, and the heirs to Adam Smith can no longer claim credit for the progression of prosperity delivered by the heirs to James Watt.

The scope for knowing

The second opportunity offered by the ‘two economies’ concept is the ability which it provides for us to interpret and model the real and financial economies independently of each other.

Comparing, say, dollars with dollars can’t really tell us all that much. Comparing dollars with joules, or BTUs, or tonnes of oil-equivalent, on the other hand, opens up broad new avenues for interpretation, innovation and, be it added, quantitative measurement. It would be ironic, but in no way surprising, if the ending of two centuries of assured growth coincided with a fundamental rethink about how the economy actually functions.

It’s for each individual to decide whether he or she accepts the concept of two parallel economies. My view is that it’s a truism about how the economy works. This concept makes it possible to calibrate and compare the material and the monetary.

Simply stated, we can use what we know about the material economy to reference what we think or are told about the financial one.

We can reasonably conclude that these two economies were closely linked for most of the industrial era, with monetary claims advancing at pretty much the same pace as material wherewithal. We weren’t driving a wedge between the financial and the material because, for as long as material growth continued, we had no need to fake it. The dangers of monetary recklessness had been understood at the level of general consciousness long before they were exemplified for subsequent generations by the Weimar hyperinflation crisis.

We can also, incidentally, view the experiences of the interwar years as something of a precursor for what’s happening now, with financial over-expansion in the 1920s resulting in the Great Depression of the 1930s. The world’s productive potential in 1930 was no smaller than it had been in 1920, and may well have been greater. What had gone wrong was that the financial had been allowed to get out of sync with the material.

The big difference – and it’s massive – between then and now is that, whilst the material economy remained capable of much further expansion as of 1930, this is not the case today. Back in the 1920s and 1930s, we made a mess of ‘the financial economy’, but were bailed out by continuing growth in ‘the real economy’. This cannot happen now.

Throughout the industrial era, we – or our leaders on our behalf – have made some colossal mistakes. Whenever this has happened, we’ve been rescued by growth. We’ve even seen countries laid waste by war turned into modern economic success-stories. In short, we’ve been able to ‘grow out of’ the consequences of our blunders, much as youngsters ‘grow out of’ childhood ailments.

My analysis indicates that this recovery capability no longer exists, because the underlying economic dynamic has turned against expansion. If we, or those taking decisions for us, carry on getting things wrong, we’ll have to live with the consequences.

Of ‘in and out’

Analytically, drawing a distinction between the two economies enables us to see the material economy for what it is – a system which uses energy to convert raw materials into physical products and services. We can define the output of this system as value, because we wouldn’t produce these various goods and services unless we valued them.

We can further observe that much of the material value thus created ends up in landfill. We can also say that ‘consumerism’ has been a product of an expanding material economy. We know that all of this is determined by the supply, value and cost of energy.

Just as money has value only as ‘claim’, and energy is the prerequisite for the supply of products and services, it’s an equally obvious fact – our third – that energy, as well as providing value, comes at a cost.

We can’t produce and consume oil or gas without wells, refineries, processing plants and a physical distribution system. We can’t put coal to use without investing in mining equipment. We can’t access wind or solar power without manufacturing turbines, solar panels, batteries and supply grids. We can also state, factually, that none of the infrastructure required to put energy to use can be made available without the use of energy.

The result is an ‘in-out’ energy equation, describing a process where we ‘use energy to get energy’. We benefit from this activity only when ‘energy out’ exceeds ‘energy in’. This comes pretty close to being a law of nature – an animal or a bird survives if, and only if, the energy obtained from consuming food exceeds the energy expended in obtaining it.

The role of money

We could, if we so decided, study and calibrate the ‘real economy’ entirely in energy units, without bringing money into the equation at all. But we need to express the real economy in financial notation if we’re to use it as a benchmark for referencing the parallel ‘financial economy’ proxy. The main purpose of the SEEDS model is to measure the ‘real economy’ and express it in financial terms, thereby making ‘two economies’ analysis possible.

We need to be quite clear about the temporal (over time) nature of money. If a certain amount of money arrives in somebody’s pocket today, he or she makes a choice between spending it now, or putting it aside for later.

Therefore, the financial economy exists in two forms – the flow of money used in day-to-day transactional exchanges of products and services, and the stock of money which, we assume, gives us valid claims on material products and services in the future.

This ‘now-or-later?’ choice is central to the entire financial process. The system can be managed in ways which influence this choice. If interest rates – more broadly, returns on invested capital – are high, people have an incentive to save. Saving is important, not just in allowing individuals to provide for the future, but also because it supplies capital for investment. If, on the other hand, returns on capital are low – and especially if inflation seems set to destroy the future purchasing power of money – people are incentivised to spend rather than to save.

We need to be quite clear that the distinction between stock and flow, which is so critical for the ‘financial economy’, has no counterpart in the ‘real’ economy. We can create monetary claims whose point of exercise lies decades in the future. But we measure the storage of fossil fuel energy in months, and electrical power in minutes.

The Naked Emperor quotes Czech economist Tomas Sedlacek to the effect that the interest-bearing credit system enables us to “energy-strip the future to the benefit of the present”. Another way of putting this is that, since debt is ‘a claim on future money’, whilst money itself is ‘a claim on energy’, it follows that ‘debt is a claim on future energy’.

Logically, this requires that anyone issuing or taking on a debt in the present ought to know whether this debt can be honoured by the amount of energy that will be available when the debt falls due for repayment.

This, of course, isn’t how the credit system actually operates. Lenders and borrowers simply assume that the economy, seen entirely in monetary terms, will expand enough over time to enable debt and interest to be paid.

The state of play

Here, then, is what we know about the ‘two economies’.

The ‘real economy’ is an energy system, and is defined as the use, in the present, of energy to supply products and services of value. The factors that determine the size of the real economy at any given time are the supply, value and cost of energy. Activity made possible by energy includes the construction of productive capacity, infrastructure, and facilities such as homes, hospitals and schools.

The ‘financial economy’ consists of monetary claims, of which some are exercised in the present, whilst others are set aside for the future. The financial system comprises an aggregation of forward claims, whose viability depends on the delivery capacity of the real (energy) economy of the future.

As remarked earlier, when creating these claims, we don’t assess their viability by enquiring into the probable size of the real economy of the future. We simply assume that the economy, defined financially, must carry on expanding.

On this basis, we have constructed a financial system that prioritises innovation over sustainability. Now that the ‘real’ economy has stopped growing, we’re about to discover that we have innovated our way to a systemic crisis.

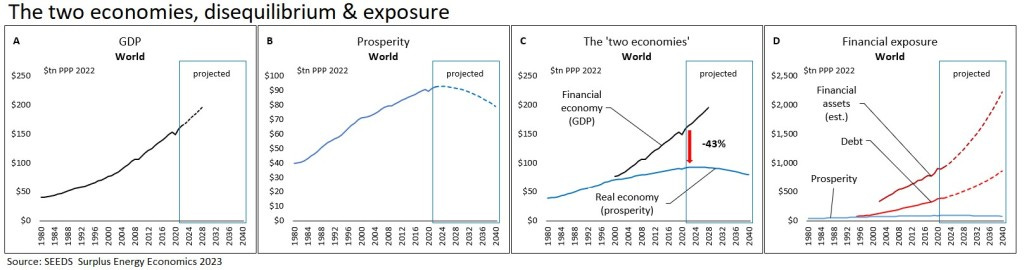

The SEEDS model uses many techniques and metrics to interpret and describe the ‘two economies’ of energy and money, and some of the most important are summarised in the following charts.

The ‘financial economy’, represented by reported GDP, has carried on growing, largely because the transactional activity recorded as GDP has been inflated artificially by the breakneck creation of ever greater future claims (Fig. 1A). In other words, we’ve been flattering perceived flow by adding to the stock of liabilities, and then turning a blind eye to the linkage between the two.

Largely out of sight, the ‘real economy’ has been decelerating towards contraction (1B). This has happened because, through the process of depletion, the ECoEs – the Energy Costs of Energy – of fossil fuels have been rising relentlessly, reducing the amount of prosperity obtained from each unit of energy consumed.

Accordingly, a severe disequilibrium has emerged between the real and the financial economies (1C).

It’s only when we recognize that the eventually tendency must be towards equilibrium between the two economies – and apply the measured magnitude of disequilibrium to the current scale of forward liabilities (1D) – that we become aware of the inevitable destabilization of the financial system.

Fig. 1

What happens next?

By applying the logic of ‘the two economies’ to prior trends and current conditions, we can develop considerable visibility about the future course of economic and financial events.

Barring the discovery of a full value replacement for fossil fuels – which hasn’t happened yet, and is highly unlikely to happen within the limited time available – material prosperity will carry on contracting. The energy-intensive nature of so many necessities implies that, as the real costs of essentials rise, there will be a leveraged decline in the affordability of discretionary (non-essential) products and services.

Inevitably, we’re going to try to stave off these realities using financial gimmickry. This could be characterised by the suppliers of non-essential products and services trying to bolster their sales by providing credit to their customers. There are limits to how far the authorities can (or might be prepared) to contain this conversion of the economy into a BNPL (‘buy now, pay later’) system.

We need simply note that, every time we try to prop up parts of the real economy by borrowing from the future, we bring the financial system itself nearer to the edge of the cliff.

The only meaningful way in which we can assess the outlook for the financial system is by viewing it as an aggregated stock of financial claims on the real economy of the future. The sheer scale of disequilibrium and exposure in the system makes a crisis inevitable.

Asset prices can be expected to slump, but what really matters is the scale and viability of liabilities. We don’t even have a full calibration of the scale of these liabilities. The authorities could, of course, try to inflate away the real value of these commitments, but they cannot prevent a countervailing increase in outstanding liabilities, most obviously in the “shadow banking” sector.

One does not need to be an advocate of unlimited government power to regret that the regulatory remit of the authorities doesn’t extend further into the supply of credit. There’s a case for saying that, whilst the protection of the individual as depositor is important, there is a macroprudential case for far greater protection of the citizen as borrower.

How these issues – falling prosperity, rapidly decreasing discretionary affordability and systemic financial crises – are likely to unfold is in part a matter of speculation, but it does seem to me that certain preparatory measures might usefully be put in place.

It should already be apparent that we need a blueprint for a post-crisis financial system. Likewise, we need to think about how to cope with widening and worsening hardship as the economic means of many falls below the costs of necessities. If we can reach a point at which leaders cease to promise that a ‘temporary’ period of hardship will be followed by the ‘sunlit uplands’ of “sustainable growth”, some progress, at least, will have been made.

Trouble is there are also two main ideologies going along with this split in economic view. One ideology automatically 'thinks' centralized preparation/planning is the key (see the above essay, as an example), while the other knows all the billions of individual human "CPUs" will have to laboriously and experimentally work out the needed aggregate solution piecemeal. Centralized preparation/planning hasn't exactly shown itself fitted for this sort work, after all -- see the last 70 or so years of increasing 'financialization' and the last 3 years of 'the COVID' as examples of what I am referring to.

Once again the same old crud "...conventional economics makes the illogical promise of ‘infinite growth on a finite planet..."

That is a just more Malthusian, DeGrowth propaganda from people who have no data so they rely on hand-waving arguments. Do these grifters even know what the word "infinite" means? If we expanded our population a trillion X and used a trillion X the resources, that's not infinite growth. In fact it is infinitely smaller than infinite growth.

The Truth, not Nonsense: Of course Growth is limited. And those limits are complicated and virtually all of them are temporary limits until technology or human interests change. The two most important factors are population on the demand side and energy on the supply side. They are overwhelmingly the most important constraints on growth.

Population: The latest and most accurate assessment of World population is it will peak @ 9.6B in 2064 and then fall to 8.9B in 2100. And that doesn't take into account the large increase in death rate since the Covid Plandemic.

Energy: We are running into a bottleneck on energy. First it will be oil. Followed in about 20-50yrs by gas. Followed by Coal in a similar period. Renewables, are a joke and not even remotely capable of replacing fossil. Far worse than a joke, they are a scam, and reek of an enforced DeGrowth Malthusian Agenda. Nuclear energy however is for all intents and purposes unlimited. Both fission & fusion. And BTW we can likely do fusion economically right now. Just the land area of the Earth has enough Uranium & Thorium to power our current civilization for 100Myrs. And there are much larger resources on the Moon, Asteroids & Mars.

So the reality, limits on Growth is an arm-waving fable pushed by Rent Seekers who just love Scarcity because that = high rents.