Is Credit Suisse about to be the new Lehman Brothers?

Something is brewing in the financial world

Credit Suisse, as the name suggests, is a Swiss investment bank, headquartered in Zurich. It is one of the nine “bulge bracket” banks along with the Bank of America, Barclays, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, UBS and Deutsche Bank (which I intentionally left until last and will discuss later on). The bank is systemically important according to the Financial Stability Board.

So, what’s the big deal about Credit Suisse (or Debit Suisse as it is now being referred to)? According to a staff memo from it’s CEO two days ago, the bank has solid capital and liquidity. “I trust that you are not confusing our day to day stock price performance", he asked his staff, before adding that he was unable to share details of a transformation plan before 27 October.

However, there is much speculation that at least one major bank is not fine and could create the next Lehman Brothers moment. ABC Australia, quoting ‘a credible source’, reported that a major investment bank is on the brink. Morgan Stanley have said that the surging US dollar is setting the stage for “something to break” in the financial system. The Bank of America have warned that the Fed is about to break the corporate bond market.

The two which are in the worst shape are Deutsche Bank (heavily exposed to the energy crisis) and Credit Suisse. Both are already trading at distressed valuation but I’ll focus on Credit Suisse in this post.

Credit Suisse has been involved in a number of scandals over the recent years which has cost it a lot of money. The Archegos scandal forced a $5 billion writedown which followed a collapse of its $10 billion supply chain finance funds. Money laundering issues have also not helped things.

This has meant it has had to pull out of a number of highly profitable areas whilst the remaining areas it’s focussed on have massive risk management problems. This has significantly pushed up funding costs and the transformation plan, referenced by it’s CEO, will be incredibly complex, involve significant downsizing and will take a long time.

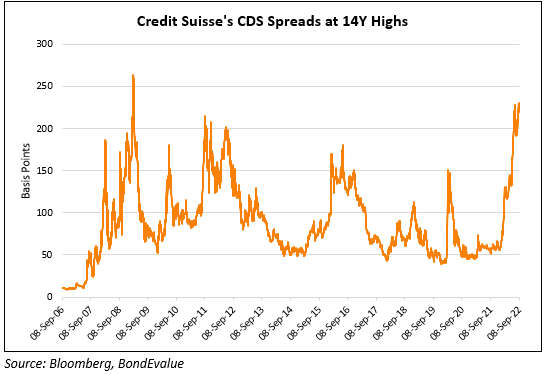

The bank’s credit default swap (CDS) price is close to surpassing levels last seen before the financial crash in 2007/2008.

It’s share price isn’t looking too great either. Nor is Deutsche Bank’s.

According to some financial journalists, Federal Reserve officials are getting more worried about “financial stability” over inflation. Higher rates are causing panic in the bonds and derivatives markets with a Fed watcher saying that the recent UK intervention was not a one off, meaning if a systemic risk happened in the US, it would cause the Fed to pause.

Already (within one week), the Bank of England have said its limited intervention may need to become more permanent. How long before the Fed pivots and the dollar printing presses are turned on again to prevent financial instability… caused by the Fed (well, central banks in general) printing money and lowering interest rates to super low rates due to financial instability?

Keep an eye on this tomorrow.

We are stuck in a situation now where there are two options - print more money and turn into the Weimar Republic or raise interest rates to curb inflation but destroy the economy.

Or will a third method be called upon this time? Not bank bail outs this time but bank bail ins. Since the last financial crash this method has been quietly introduced to deal with a collapsing bank.

From the Bank of England website.

A key benefit of bail-in is to ensure that large banks can fail in an orderly way: continuing to provide key activities for the economy whilst losses are imposed on a failed bank’s shareholders and creditors, rather than depositors and taxpayers.

So in the event of a bank failing, losses can legally be imposed on a failed bank’s shareholders and creditors. At least your money as a depositor is safe though, right? Wrong, only deposits protected by a financial compensation scheme (in the UK up to £85,000 per person) are excluded from bail-ins. However, deposits would only be subject to bail-in if losses are so high that subjecting all the shareholders and “a number” of debt holders (doesn’t say all debt holders) would not be sufficient.

Could this be the reason Pope Francis ordered all global assets to be returned to the Vatican bank by the end of September? In the Pope’s 23 August rescript he provided “clarification” (which looked liked direct contradiction) on a paragraph of the new constitution promulgated in March. The rescript ordered all financial and liquid assets to be returned to the Vatican bank.

And in typical, demonic fashion, “God’s representative on Earth”, who is every bit in line w/ the rest of his WEF & Davos pals, scurries to not have HIS Catholic institution & its enormous wealth suffer the consequences of the very socialist & worse policies & actions to which he is a party, true believer & practitioner.

UK Chaos Economics: Fretting over “Financial Stability” & “Contagion” after Gilts Plunged, Bank of England Buys Bonds

It wasn’t big hedge funds that blew up, but £1.5 trillion in leveraged pension funds. BoE stepped in to bail them out and prevent further contagion.

Over the past few days, the pound plunged, including with a flash-crash on Monday that briefly took it to record lows against the US dollar. Prices of long-dated bonds went into a death spiral, with the 10-year yield spiking by 130 basis points in four trading days to 4.63% early today, and by 275 basis points in seven weeks ago (up from 1.88% in early August).

The bond market reaction represents a colossal and sudden degree of “tightening” of the financial conditions, before the Bank of England’s QT had even started. QT is designed to bring up long-term yields, but they already exploded due to chaos.

It was the market’s backlash against the new government’s reckless plan to cut taxes for the rich and for corporations, funded by new debt, while piling on spending to subsidize energy costs, also funded by new debt, thereby requiring the issuance of large amounts of new debt, even as inflation has already reached to 10%.

The Bank of England, which is in charge of maintaining financial stability, now has a slew of problems to deal with: inflation spiraling out of control, currency plunging, bond market in chaos, financial stability at risk, and spreading contagion. And some of them require the response that the others require. So this is a mess, and there are no good solutions.

The BoE chose to maintain financial stability first because the bond market chaos was starting to blow up the financial system, as leveraged pension funds were getting collateral calls triggered by the spike in yields, and as UK lenders had suspended making mortgage offers because no one knew how to price them amid this chaotic volatility in bond yields.

Worried about “contagion” and “financial stability”

So the BoE came out today and said that it would purchase long-dated gilts with remaining maturities of over 20 years. The purchases would go through October 14.

“The purchases will be unwound in a smooth and orderly fashion once risks to market functioning are judged to have subsided,” it said.

And the 10-year yield plunged by around 60 basis points, to 4.01% at the moment, undoing the spike early today and yesterday:

Specifically, the BoE said it’s “monitoring developments in financial markets very closely in light of the significant repricing of UK and global financial assets.”

“This repricing has become more significant in the past day – and it is particularly affecting long-dated UK government debt,” it said.

“Were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability,” it said.

“This would lead to an unwarranted tightening of financing conditions and a reduction of the flow of credit to the real economy,” it said.

“In line with its financial stability objective, the Bank of England stands ready to restore market functioning and reduce any risks from contagion to credit conditions for UK households and businesses,” it said.

“To achieve this, the Bank will carry out temporary purchases of long-dated UK government bonds from 28 September,” it said.

“The purpose of these purchases will be to restore orderly market conditions. The purchases will be carried out on whatever scale is necessary to effect this outcome,” it said.

“These purchases will be strictly time limited. They are intended to tackle a specific problem in the long-dated government bond market,” it said.

“Auctions will take place from today until 14 October. The purchases will be unwound in a smooth and orderly fashion once risks to market functioning are judged to have subsided,” it said.

Bailing out leveraged pension funds.

Defined-benefit pension plans in the UK that were using an investment strategy, called liability-driven investment (LDI), got hit by collateral calls as long-dated gilts went into the death spiral.

“The amount of liabilities held by UK pension funds that have been hedged with LDI strategies has tripled in size to £1.5 trillion in the 10 years through 2020,” according to Bloomberg.

BlackRock, Legal & General Group Plc, and Schroders Plc manage LDI funds on behalf of pension clients. “The pension firms use them to match their liabilities with their assets, often using derivatives,” according to Bloomberg.

“LDI collateral buffers are partly set using historical data to build models based on the likely probability of gilt price movements,” Shalin Bhagwan, head of pension advisory at DWS Group, told Bloomberg.

I mean, surely this strategy is very conservative and is not risky at all and is very suitable for £1.5 trillion in pension funds. Until it suddenly blows up.

The massive spike in yields of long-dated gilts “blew through the models and the collateral buffers,” Bhagwan told Bloomberg. LDI funds got margin calls from their investment banks and had to post more collateral.

To meet the collateral calls and maintain their LDI positions, pension systems asked their managers to sell holdings in equities, bonds, and UK open-ended real estate funds, Bhagwan told Bloomberg.

And that’s precisely how contagions spreads: by having to sell unrelated assets in order to meet margin calls.

“The BOE had been warned by investment banks and fund managers in recent days that the collateral requirements could trigger a gilt crash, according to a person familiar with the BOE’s deliberations before they stepped in,” according to Bloomberg.

“The BOE intervention was required to prevent a vicious cycle becoming even more dangerous for pension funds forced to sell their gilt exposures,” Calum Mackenzie, an investment partner at Aon, told Bloomberg.

“The market’s swift and significant reaction underlined the big risk faced by pension funds who have had or who could have had their liability hedges reduced,” Mackenzie said.

“Any pension funds which has used even moderate levels of leverage are struggling to keep pace with the moves,” Mackenzie told Bloomberg before the BoE stepped in. “You have a bit of a death spiral potentially where pension funds in particular are being forced to sell because they’re breaching their leverage agreements with their LDI counterparties.”

The Pensions Regulator told Bloomberg today:

“We are monitoring the situation in the financial markets closely to assess the impact on defined benefit pension scheme funding.”

“We again call on trustees of DB schemes and their advisers to continue to review the resilience and liquidity of their investments, risk management and funding arrangements, and plan accordingly to protect the interest of scheme members.”

So there you have it --- continue raising interest rates and the financial system implodes.

Drop interest rates and already dangerous inflation ... will result in hyper inflation.

3 words to summarize this: We are F789ed.