Financial Crash - Bank of England warns Pension Funds - You have 3 days left to rebalance

Money markets aren't happy

Less than two weeks ago I reported on how the UK was in financial trouble. In reality, it’s the whole financial system that is on the verge of collapsing, with the UK providing the initial tremors, signalling an imminent earthquake is on the horizon.

It started off with the Bank of England (BoE) making an extraordinary intervention due to pension funds being on the verge of collapse. Due to interest rates effectively being negative for the past decade, pension funds had been seeking higher returns in riskier products. All fine when interest rates stay low or get lower but if they suddenly rise, like they have done this year, you’re in trouble.

So the BoE stepped in and said it would purchase UK government bonds to restore orderly market conditions. This was just after it had announced it was selling UK government bonds, so really signalling confidence to the market! It would offer to buy up to £5billion per day (£65 billion in total) until 14 October.

In my article less than a few weeks ago, I said:

How long will this intervention last this time. The 2008 intervention lasted about 10 years. The 2020 intervention lasted a couple of years. This crisis? A few months, weeks?

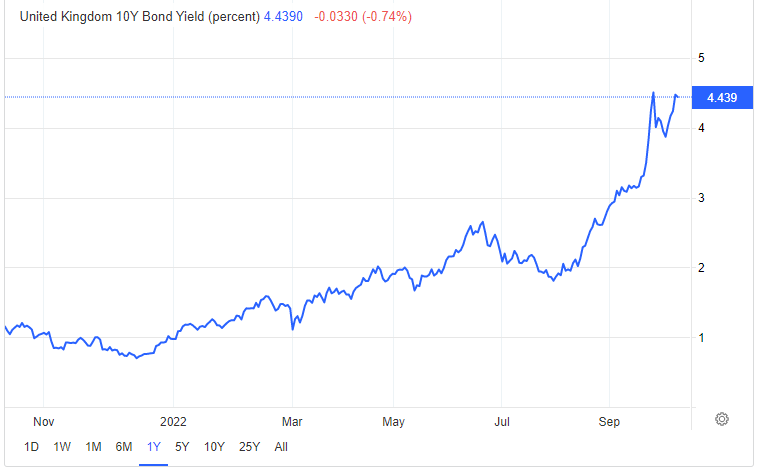

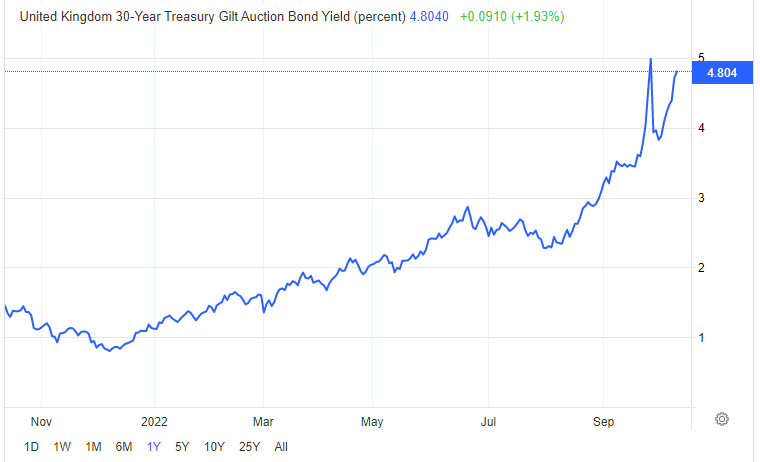

Turns out weeks was the right answer. Surprisingly, there wasn’t much interest in the BoE’s offer and they bought nowhere near the amounts the were offering. Initially, UK bond yields dropped on the BoE’s intervention but that didn’t last long and they quickly reversed direction. So much so that yesterday the bank announced that it was doubling the amount it was offering to buy each day and today it extended its intervention to purchase index-linked gilts. Index-linked gilts are another product typically held by pension funds which are the source of all the panic. It warned of “a material risk to UK financial stability”.

UK 10 Year Bond Yield back to levels before the BoE intervention

UK 30 Year Bond Yield just under levels before BoE intervention

As this Friday’s deadline gets closer there has been much speculation as to what the BoE would do. Would it extend its intervention scheme, effectively printing money again and ignoring inflation rates or would it stop as it had promised. The markets are desperate for more free money to keep their bubbles pumped up but equally continuing the intervention signals a far bigger problem than originally thought.

The Institute for Fiscal Studies (IFS) commented on the general situation, saying “Overall, we forecast that borrowing this year will be £194 billion, which would be £94 billion higher than the £99 billion forecast in March”. Not much of a change there then!

Today the Pension Fund Trade Body announced that it feels that the BoE intervention in the Gilts market should be extended to October 31st and possibly beyond. “feels” presumably means you had better bloody do as we say or we’re going under, mate.

However, they got their response this evening with the BoE announcing the emergency support will end this Friday. BoE Governor, Andrew Bailey, told pension fund managers at an event in Washington:

“We have announced that we will be out by the end of this week. We think the rebalancing must be done.”

“And my message to the funds involved and all the firms involved managing those funds: You’ve got three day left now. You’ve got to get this done.”

The markets didn’t respond well. Can you see at what point in the chart below, the Governor made his comments? Can you see at what point the markets said “LOL, you don’t stop printing money unless we say, Bitch”.

GBP/USD

The Pound is now trading at 1.09 versus the Dollar but as I have pointed out before, this is part of a long-term downward trend.

How long before the market’s hissy fit causes the Bank to reverse its position again and extend the intervention. Much like a drug addict, the markets can’t be weaned off their financial stimulus easily.

If the BoE do want to end their emergency stimulus on time they either need to find a whole new selection of buyers for bonds or get the government to massively cut spending. Either of those things are very unlikely.

But if you aren’t in the UK, don’t read this article smugly, if we go down, the whole system goes down. That’s not a threat, it’s just a fact.

The IMF published it’s Global Financial Stability Report today and it’s not pretty. High inflation, falling asset prices, volatile markets, energy crisis, investor runs and asset fire sales, financial stability threatened and mortgage rates rising. Don’t read if you’ve just been vaccinated, your heart might not be able to take it.

In the US, the Fed is still looking like it might pivot with more talk about the risks of over-tightening (i.e. removing money from the system instead of printing more). Vice Chair, Lael Brainard warned that lags in policy could impact the economy in the months ahead. She cautioned against central banks raising interest rates to curb high inflation.

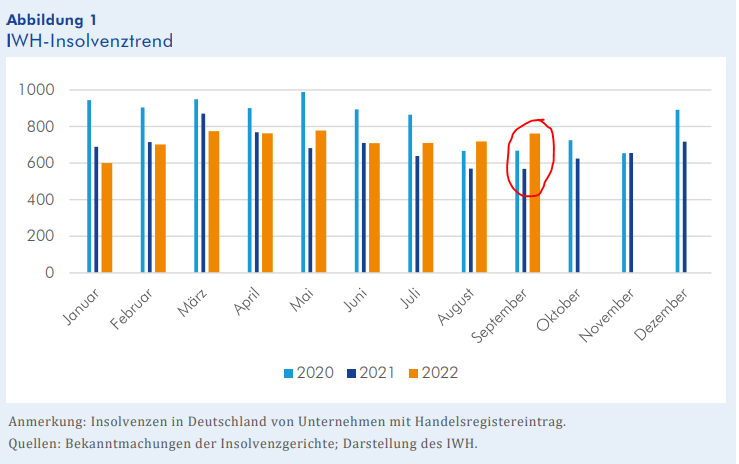

The EU is probably already doomed with its powerhouse, Germany, in big trouble. With an energy crises on the cards and industry likely to shut down this Winter, corporate insolvencies are on the rise. (Not that the UK is any better, with company insolvencies hitting a 13-year high).

Germany has been forced into a corner and are going to pay all gas bills for households and businesses in December. That’s definitely an interesting way to reduce pressure on gas usage. Looks like Europe will be running out of energy sooner than expected.

Bonds in Germany are also sky-rocketing and are now higher than in 2008. This is also forcing pension funds to liquidate their positions. A portfolio manager at one of Germany’s largest insurance companies said, “It’s a global margin call. I hope we survive”.

Japan’s 10 year government bonds were untraded for the third session in a row. This has never happened before.

So to sum up, central banks are printing money again to cover up the mess they have made and curb inflation, caused by printing money. This will increase inflation and make the mess even worse. A doom spiral.

All this comes in the week that Ben Bernanke (who’s response to the 2008 crash is coming home to roost now) won the Nobel prize for economics.

Clown world!

Gee, with the events of the past 2 1/2 years it’s almost like this whole thing has been planned....

I put this up FA Hayk Road to Serfdom 2, https://gailhonadle.substack.com/p/fa-hyek-road-to-serfdom-2

There are more Links in the comments, one is on the UK