The following is a guest post from The Consciousness of Sheep

One of the problems with claims that our situation is “just like the 1970s,” is that very few adults of the period are still around to share the memory. Those of us who were children at the time have only memories distorted through the lens of childhood innocence. I, for example, have a memory of the lights going off during the “three-day-week,” together with cloudier memories of petrol shortages in the autumn of 1973. But we children had little appreciation of the hardships that these events caused our parents – being unable to cook dinner, not being able to drive to work, etc. The inflation which followed was even less tangible to a child who had few things to spend pocket money on back then. It is only later in life that I came to appreciate just how much effort my mother had to put into feeding two kids with ingredients which seemed to go up in price week to week and month to month.

What I “remember” of the 1970s is actually very limited. Most of what I think of as “my memories” have, in fact, been generated by various retrospective media coverage of the period which provide the framework into which my scraps of memory have been slotted. And the younger someone is, the more their view of the 1970s will have been shaped by media rather than memory. And so, it has been all too easy for today’s lazy news coverage to frame our current woes through the lens of an imaginary 1970s.

The crisis now unfolding, however, is entirely different to the 1970s in one crucial respect… The 1970s crisis was largely artificial. When all is said and done, the oil shock was nothing more than the emerging OPEC cartel asserting its newfound leverage following the peak of continental US oil production. There was no shortage of oil any more than the three-day-week had been caused by coal shortages. What they did, perhaps, give us a glimpse of was what might happen in the event that our economies depleted our fossil fuel reserves before we had found a more versatile and energy-dense alternative. Although a widely repeated conspiracy theory in those days claimed that the oil corporations had bought up all of the patents for alternative energy technologies, and that once they had screwed the last dollar out of the sale of expensive oil, they would reveal – and profit from – an entirely new energy infrastructure.

And so, in the 1980s, as new oil began to flow from North Alaska and the North Sea, we all went back to sleep again. At least until those deposits – and indeed, the entire world’s conventional oil reserves peaked and went into decline in the early years of the twenty-first century. Only then did we discover that the leading economies of the world had been built upon a mountain of debt whose repayment ultimately depended upon an ever-growing supply of cheap oil. Just as has happened in the last year, when the price of oil goes up, the price of everything in the economy goes up accordingly. This, in turn, obliges the mass of households to switch their consumption from discretionary to essential items. The ensuing slowing of the broad economy – discretionary consumption being far greater than essentials – together with central banks jacking up interest rates and governments cutting spending and raising taxes, pulled the rug out from beneath the debt mountain effectively bankrupting the western banking and financial system.

That system has been on the life-support of quantitative easing and near zero interest rates ever since. Indeed, so perilous a state has the system been in since 2008, it was essential that the people who claim to be our leaders avoid doing anything so foolish as to lockdown the economy or launch an undeclared economic war on one of the world’s biggest commodity exporters. As I have said elsewhere though, instead of true leaders we are cursed with:

“[a] basket of sociopaths, spivs, clowns and gentlemen whose proper place is in a care home for dementia…”

And as the UK has demonstrated recently, the single reason for keeping these in place is that there is nobody else even vaguely competent to take over. And this is structural, of course. Because a huge difference from the 1970s is that in those days, governments administered whole swathes of the economy – including keeping private banks in their place so that they couldn’t wreak the kind of damage that they had in the run up to the 1929 crash. These days governments just pass mountains of unworkable legislation in the hope that someone else will figure it out. Meanwhile even our most important critical infrastructure has been handed off to private corporations and hedge funds in the vain hope that they won’t screw us before leaving us with the bankrupted shells.

To be a political leader today is merely to step up another rung on the ladder to becoming a hedge fund exec or a CEO of the latest subscription TV network… a process which requires only the ability to act as if you know what you are doing. Competent statesmen need not apply, since, after four decades of neoliberalism, there is no longer a place for them.

But let us not forget that it all seemed to work well so long as the oil kept flowing and the unrepayable debt mountain kept growing. The economic and political strife of the 1980s had subsided in the more prosperous 1990s. The Cold War was over and, apparently, we were enjoying a “peace dividend.” For those lucky enough to have a salaried position and a home of their own, all seemed well in the world.

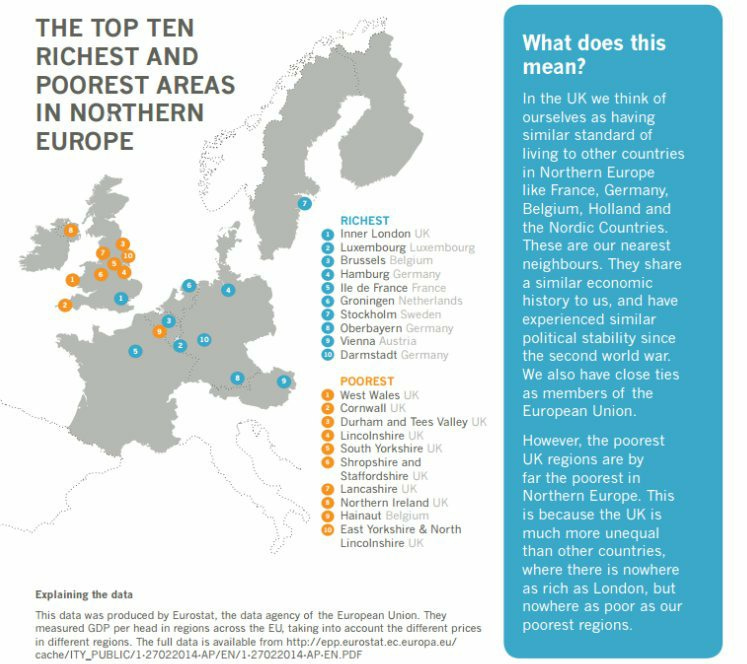

There was a dark side though. Away from the metropolitan cities and the gated communities of the new managerial class, ex-industrial, rundown seaside and smalltown Britain was already getting a taste of the economic decline to come. The governments of the 1970s and even the 1980s would have attempted to “do something” to revive the fortunes of these places. Thatcher, for example, provided the funds for new industrial parks together with the grants for small businesses to work within them – one unforeseen consequence of which was the emergence of the “Brit-pop” bands of the 1990s, who had bought their instruments and recorded their first albums using Thatcher’s Enterprise Allowance. By the time Clinton and Blair arrived to introduce a more punitive version of neoliberalism, these places had been written off. It was not for the state to create the conditions to bring work to these decaying places, it was for their residents to uproot, re-train and move to where the jobs were. And so, Britain completed its journey from being a “nation of shopkeepers” to a nation of shop assistants:

It was these “places that don’t matter” which were at the heart of the populist revolt of 2016. But their population waited in vain for someone to “take back control” or to “make America great again.” And as the authoritarian response to the Covid proved, it was all too easy for the neoliberal technocracy to reassert itself and to take control of our day-to-day lives, and even our bodily autonomy, in a manner which would have been unthinkable just months before.

In punishing the people for our populist insolence, however, the technocracy – whether by design or incompetence – has brought ruin down upon itself. And this is why the crisis we are beginning to experience will make the 1970s look like a golden age of peace and tranquillity. For while there are some who take comfort in the belief that there is some “They,” some all-seeing eye at the top of the pyramid, the reality is that hierarchies don’t work that way. Not that people don’t conspire, of course, and powerful people’s conspiracies are generally more successful. But in the real world, the pyramid works as a giant censorship machine which – like the human mind – works to filter out all of those nasty things that might otherwise threaten one’s fragile worldview. It is far more likely, for example, that Klaus Schwab believes all of the Fourth Industrial Great Green New Reset bullshit than that he is using it as a cover for something more nefarious, simply because nobody in his employ dare tell him that his vision defies more laws of physics than Star Trek ever did.

The sad reality though, is that our leaders – at least within the western empire – have bought into a vision of the future which cannot work without some new and yet-to-be-discovered high-density energy source (which rules out all of the so-called green technologies whose main purpose is to concentrate relatively weak and diffuse energy sources). Worse still, these idiots believed that they were in control and that they had choices. In reality – and there have been an army of geologists, engineers, physicists and even a handful of contrarian economists who have tried to explain this – the fossil fuels which still account for 85 percent of the energy (Nuclear and Hydroelectric account for most of the rest) which powers everything we do are a precious and finite resource. And insofar as our economic demand for growing energy supplies has been insatiable, so we have brought forward the day when it was no longer possible to keep providing additional energy… and thus economic growth.

In a sense, the disciples of Herr Schwab are like so many children on Christmas morning, so enchanted by the thought of playing with their new toys that they haven’t noticed that there were no batteries included, and that without power, all of those toys are useless. Except that in the real world the shops are not going to be open on Monday and there are no batteries anymore.

Well, that’s not quite true. We still have access to massive quantities of oil, gas, and coal. Its just that we are going to have less and less, and they are going to cost ever more with each passing year. And whichever way you cut it, that means that our economic activity is going to have to scale back accordingly. Which is another reason why the actions of our self-identifying leaders have been so damaging. Because the rest of the world would quite like to continue raising their living standards and are not so keen to allow the western empire to continue to consume the lion’s share of the planet’s energy resources.

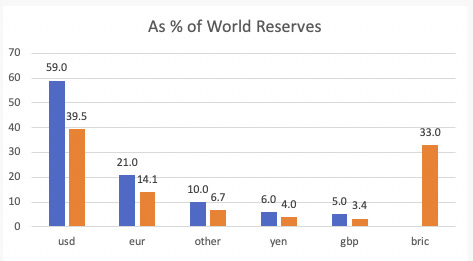

Western leaders have been more or less explicit in saying that the purpose of the sanctions salad imposed on Russia was to undermine the Russian economy and to bring abut regime change. The quiet part – which even Biden has managed not to splutter out loud – is that following regime change, western corporations were going to go in and rape Russia for all of its vast commodities, including the last large oil and gas fields on Earth. Unfortunately, they placed far too much reliance upon the reports of Washington (neocon) thinktanks which have been situating their appreciation of a backward Russia ever since the collapse of the Soviet Union. What they failed to notice is that Russia – and, indeed, the BRICS block as a whole – had been preparing to defend against a western economic war for the best part of a decade. So that not only have the western leaders holed our economies beneath the waterline by their de facto self-embargo of fossil fuels, metals, fertilisers and food, but far worse again, they have undermined the dollar system which has allowed the citizens of the western empire to live beyond our means for the last eighty years. As Philip Pilkington at UnHerd reports:

“This week it was announced that Iran and Argentina had applied to join the BRICS. The BRICS — which until recently has been made up of Brazil, Russia, India, China, and South Africa — is a forum that allows countries outside of Western developed economies to forge alliances on economic issues. As it gets larger, its influence and economic importance grows.

“Last week at one of the BRICS forums President Putin announced that Russia, alongside China and other BRICS nations, was getting ready to launch a new global reserve currency made up of a basket of BRICS currencies. If successful, such a reserve currency would be a direct threat to the currently dominant US dollar...

“Could a new trade bloc with its own reserve currency be a threat to the West and to US dollar dominance? Almost certainly. In their current form the BRICS make up around 31.5% of world GDP when adjusted on a purchasing power parity basis. With Iran and Argentina added, this rises to 33% of world GDP. This is a huge potential trade bloc, and 33% of global GDP is certainly enough to justify a reserve currency.

“But beyond this, the potential for synergies between the countries is enormous. Taken together, the expanded BRICS countries currently produce around 26% of global oil output and 50% of iron ore production used to make steel. They produce around 40% of global corn production and 46% of global wheat production. If these were all traded in the new reserve currency, it would instantly become a cornerstone of the world economy.”

It is difficult to imagine just how bad this is for the western economies. According to Pilkington, were this BRICS currency to emerge – and western leaders’ actions make it likely sooner rather than later – we can expect roughly a 33 percent devaluation of the western currencies… something which would result in what can only be described as hyper-stagflation, with prices of imports – including essentials like food and fuel – rising beyond the reach of all but the wealthiest westerners, even as that mountain of unrepayable debt comes tumbling down so rapidly that it will render most of what we still consider repayable bad as well.

Even as we struggle to reimagine the 1970s in an attempt to understand the current situation, the only people on Earth today who can even begin to imagine the economic and social horrors that await western populations are the survivors of the 1980s famine in Ethiopia, the hyperinflation in 1990s Zimbabwe, or, ironically, the Russians who survived the collapse of the Soviet Union.

"Just as has happened in the last year, when the price of oil goes up, the price of everything in the economy goes up accordingly."

--------

Especially when we buy everything from China.

Great article, especially the part about BRICS. They've been fighting an economic war and they're going to win without needing to fire a shot -- they're just letting our idiot 'leaders' devalue the currency.

We are as prepared as we can manage as an older couple. No debts, home free and clear, not a great nest egg, but we adjust our travel and purchases accordingly. We also have a grubstake of food to last months if things get rough and the stores empty. Note that nothing like store runs and supply chains problems are permanent, and one can't store enough food to last years. I also have an alternative to my car if fuel gets to high or there are outages. I have 2 bikes - one I have had since 1973, and one e-bike I bought last year. I can travel 30 miles with pedal assist level 1, and 20 miles on throttle alone. Round trip to town and the grocery store is 15 miles. Everyone should do what works for their situation, and remember if you are anywhere near rivers and lakes, you can fish.