The Everything Bubble, The End Of Growth & Managing Expectations

A theory to explain everything

I’m constantly looking for new theories to explain why the things that are happening in this world are happening. Why are governments pushing for ever greater control? Why did they unnecessarily destroy their economies during Covid? Why do they push a self-destructive Net Zero agenda? Why do they shout about reducing immigration only for it to rocket upwards? These are just a few of the many questions where mainstream answers just don’t make sense.

Simple explanations could include inept politicians who only think in the short term. A lack of critical thinking. Careers too finely balanced to upset the apple cart. Woke ideology not allowing people to be challenged. And risk being blown out of all proportion.

But perhaps there is another explanation. One that convinces politicians to pursue policies that don’t seem to be in the public’s interest.

One such theory that I am about to bastardise is by Dr. Tim Morgan. A reader called ‘Fast Eddy’ first told me about Dr. Morgan and I have slowly been absorbing his work. What follows is my take on Tim’s ideas, so apologies, Tim, if I have trashed your work. To read all of Tim’s work, go to his blog SurplusEnergyEconomics.

For those of you who have interacted with Fast Eddy on Substack, he often links to Dr. Morgan’s 2013 paper called “perfect storm - energy, finance and the end of growth”. This was written whilst he worked as Head of Research at Tullett Prebon, a world-leading intermediary in the wholesale financial and energy markets.

The economy is a surplus energy equation, not a monetary one, and growth in output (and in the global population) since the Industrial Revolution has resulted from the harnessing of ever-greater quantities of energy. But the critical relationship between energy production and the energy cost of extraction is now deteriorating so rapidly that the economy as we have known it for more than two centuries is beginning to unravel.

Since then, Tim has written a number of books including “Life After Growth”. His views have turned him into a controversial figure with newspapers calling him “Dr Gloom” and “Terrifying Tim”.

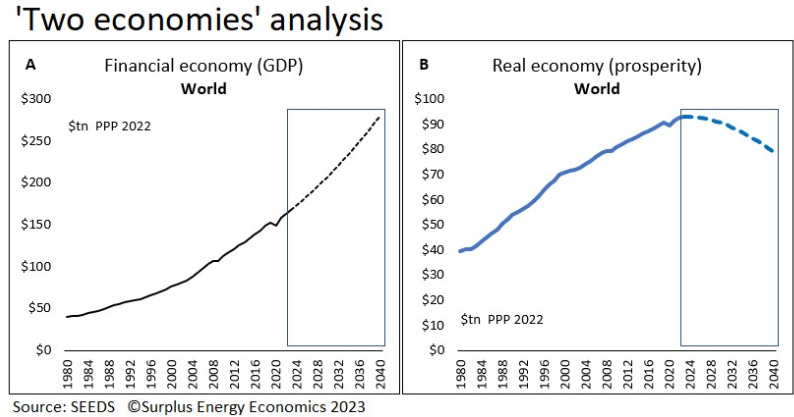

Dr. Morgan believes that there are two economies running in parallel. One is “the underlying ‘real’ or physical economy of products and services” and the other is a “financial economy of money and credit”. “Money has no intrinsic worth, but commands value only in terms of the material things for which it can be exchanged”. To better understand that concept, imagine yourself stranded on a desert island. No amount of money, whether that be coins, gold or crypto, would have the slightest value because there would be nobody with which to trade it with for food or water.

So, “the financial economy is a proxy for the real economy, just as money and credit are proxies for the products and services for which they can be exchanged”.

In the past these were closely linked with the industrial revolution starting centuries of economic growth. However, Tim argues that the two are becoming more and more detached from each other with real economic growth beginning to shrink. Between 2000 and 2007 world GDP increased by $17 trillion whilst debt increased by $55 trillion meaning each dollar of growth COST $2.20 in new debt. Since then debt has more than doubled meaning each dollar of growth now costs around $3.

If you take out a loan of $25,000 and spend it on brand new shiny things, does that make you more wealthy? No, because you have borrowed it and you still have to pay it back with interest on top.

Between 2001 and 2022, reported world real GDP – a proxy for the financial economy – expanded by 109%, a compound annual rate of growth of just short of 3.6%. Material prosperity, by contrast, grew at an annual rate of just 1.2% between those years, increasing by only 30% between 2001 and 2022.

What does this all mean? Simply, we are going to become poorer. Whilst previous generations ‘expected’ to become more prosperous than their parents, according to Dr. Tim, this will no longer happen.

Quite a lot of you will probably have noticed this already. But as Dr. Morgan points out, it is “perfectly feasible for different people to have different experiences, depending upon which of the two economies – the monetary or the material – determines their circumstances”. If you have worked in the financial sector and are part of the financial economy, you are probably doing ok…for now.

The question is, why are we getting poorer?

Briefly moving away from Dr. Morgan to Czech economist, Tomas Sedlacek can start to answer that question. His book ‘Economics of Good and Evil’ explains the concept of money as energy and the relationship between time and money.

For money is something like energy that can travel through time. And it is a very useful energy, but at the same time very dangerous as well. Wherever you put this energy in a time-space continuum, wherever you plant it, something happens there.

This time-travel of money is possible precisely because of interest. Because money is an abstract construct, it is not bound by matter, space, or even time.

Due to this characteristic, we can energy-strip the future to the benefit of the present. Debt can transfer energy from the future to the present.

To summarise, Sedlacek compares debt to a Saturday night drinking session. Even though you normally go to bed at 9pm, suddenly you are able to stay awake until 3 in the morning. How is this possible? Because you borrowed energy from the future. And then comes Sunday. Your debt must be repaid, you feel terrible, have no energy and you stay in bed all day.

We have had the mother of all parties for the last two hundred years and instead of slowing down at 3am, we carried on partying, but harder and with stronger drugs. It’s now Sunday morning and a hangover like you’ve never experienced before is about to start.

But it gets worse.

Rather than a financial system, the economy should be viewed as an energy one. If you think about it, all goods and services require some form of energy to produce and supply. Money only “commands ‘value’ only in relation to the things for which it can be exchanged – and all of those things rely entirely on energy”.

All economic output is therefore the product of surplus energy. But energy is also required to access and produce the energy in the first place. Whatever remains is surplus energy. Dr. Morgan calls the energy needed to access energy the Energy Cost of Energy (ECoE). So Surplus Energy = Total Energy - ECoE.

ECoE is critical to prosperity. If ECoE goes up then using the equation above, surplus energy goes down meaning economic output goes down.

The distinguishing feature of the world economy over the last two decades has been the relentless rise in ECoE. This process necessarily undermines prosperity, because it erodes the available quantity of surplus energy. We’re already seeing this happen – Western prosperity growth has gone into reverse, and progress in emerging market (EM) economies is petering out. Global average prosperity has already turned down.

Trend ECoE of fossil fuels has risen exponentially, from 2.6% in 1990 to 4.1% in 2000, 6.7% in 2010 and 9.9% today. Since fossil fuels continue to account for four-fifths of energy supply, the trend in overall world ECoE has followed a similarly exponential path, and has now reached 8.0%, compared with 5.9% in 2010 and 3.9% in 2000.

For fossil fuels alone, trend ECoE is projected to reach 11.8% by 2025, and 13.5% by 2030.

Dr. Morgan goes into detail about why renewables aren’t the answer, nor will they likely be for the foreseeable future. They may stabilise things but even in the unlikely scenario of stabilising ECoE at the current rates, global prosperity will still decline. “British prosperity has been in decline ever since ECoE reached 3.6%, and an ECoE of 5.5% has been enough to push Western prosperity growth into reverse”.

So with the ECoE going up and surplus energy going down, what does Dr. Morgan think the future holds? He outlines three outcomes that he expects to see.

A financial shock that will dwarf 2008;

Government breaking down in the face of failing prosperity; and

The acceleration of economic deterioration.

The financial shock will dwarf 2008 because at the end of the ‘90s ECoEs rose past 4% and Western prosperity petered out. However, this was masked with cheap and easy credit. Ultra-loose monetary policy meant cheap money flew into assets causing rampant asset inflation. This is the everything bubble. All assets have been pumped up with cheap money and all could now pop.

Dr. Morgan anticipates that as well as mass defaults and collapses in asset prices there will be currency crises due to a breakdown in trust.

Governments will break down in the face of failing prosperity because assumptions made by governments will differ from the underlying reality experienced by individuals.

Recent experience in the United Kingdom illustrates this process. Between 2008 and 2018, GDP per capita increased by 4%, implying that the average person had become better off, albeit not by very much. Over the same period, however, most (85%) of the recorded “growth” in the British economy had been the cosmetic effect of credit injection, whilst ECoE had risen markedly. For the average person, then, prosperity has fallen, by £2,220 (9%), to £22,040 last year from £24,260 ten years previously. At the same time, individual indebtedness has risen markedly.

The deterioration of prosperity explains all the recent political shocks such as Brexit, Trump and the Yellow Vests in France.

And finally the deterioration may accelerate due to risk factors including worsening trends in fossil fuel ECoEs, the financial crisis discussed above and a decline in high rates of utilisation of both businesses and public services.

So we’ve identified the problem, seen how growth has ended and discussed the everything bubble but what would politicians do with this same information. Would they ‘fess up to the public that times are about to become hard, risking civil unrest and a further acceleration in the rate of deterioration? Or would they try to manage expectations downwards?

Dr. Morgan calls this the ‘modified consensus’.

The authorities would not, and could not, say that economic growth has ceased, let alone that it has gone into reverse, and neither would any practical purpose be served by doing so. Instead, they would seek to steer expectations towards successively, but gradually, lower levels.

Suddenly a lot of the unanswerable questions above start to have answers. Why are governments pushing for ever greater control? Because they will need it to control citizens as their prosperity declines. Why did they unnecessarily destroy their economies during Covid? Because it allowed them to pump up the financial system one last time whilst tamping down demand. Why do they push a self-destructive Net Zero agenda? Because they are managing expectations downwards. If you decide that you are going to use less energy yourself, you are far less likely to riot than if you are told the energy has run out. Why do they shout about reducing immigration only for it to rocket upwards? Because with a large retired population, the only way to achieve any kind of growth or pay unfunded pension liabilities, is to attract young workers into the country.

I have asked readers before about whether they think the Covid response was due to financial or energy problems. The majority weren’t convinced so what do you think of Dr. Morgan’s theories? To me it explains a lot, if not everything, but I’d be interested to hear other views.

Western governments must have seen all this coming a long time ago so why didn't they:-

1. adopt pro-natal policies years ago instead of doing the opposite (LGBT, feminism etc) and importing often hostile minority groups?

2. implement nuclear power on a mass scale, especially fine tuning the Thorium cycle using molten salt reactors (safe, no waste, abundant fuel)?

3. continue to exploit fossil fuels rather than restrict extraction?

4. prepare to return to a sound money system instead of flogging off the gold reserves and blowing a bigger bubble, i.e. keep digging the hole bigger?

It seems to me that the Eurasian powers are doing all these 4 things and seem to see a bright future of multi-lateral cooperation out from under the Western yoke. Surely they would be in the know too if things were as bad as this guy says? Why aren't they acting like the Western countries?

"Dr. Morgan believes that there are two economies running in parallel. One is “the underlying ‘real’ or physical economy of products and services” and the other is a “financial economy of money and credit”. “Money has no intrinsic worth, but commands value only in terms of the material things for which it can be exchanged”. To better understand that concept, imagine yourself stranded on a desert island. No amount of money, whether that be coins, gold or crypto, would have the slightest value because there would be nobody with which to trade it with for food or water."

---------------------

YES YES YES YES! The way that I phrase it is that when the fake economy of money printing/handouts overtakes the real economy of voluntary transactions for goods and services, the wheels come off the bus.

The bankers and politicians will ALWAYS find excuses to print, leaving the rest of us to pay for their actions via devalued labor and savings.

Edit to add proof:

https://simulationcommander.substack.com/p/the-slow-motion-trainwreck-of-the

This is what it looks like when the fake economy of being close to the literal money makers overtakes the real economy of people voluntarily trading goods and services. Why bother with customer service or quality when you can just bribe a politician to make your product mandatory, or to eliminate your competition?

The debt will be inflated away, and it’s extremely likely the looter class will grab everything they can while the house of cards tumbles down. It’s likely millions of people will be unable to continue paying for their homes and businesses, and the politically connected will use their newly printed cash to buy up the rubble for pennies on the dollar.